Article by Wajeeha Ashfaq Hamdani from Economics Wing, GAEE JMI

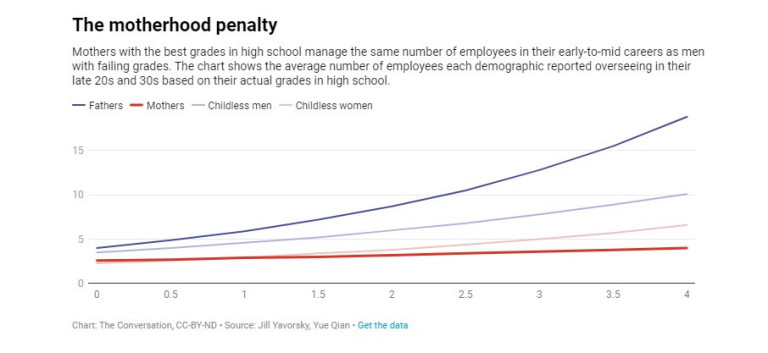

Did you know that women with children tend to earn lower wages than women without children? This shortfall is known as the “child wage penalty,” “family gap,” or “motherhood penalty.”

Mothers are paid less than women without children. After all, they can’t give their full attention because they have to care for their children. Surprisingly, the wage disparity between mothers and non-mothers is much more significant than the wage disparity between men and women.

Research on child wage penalties suggests women receive a 4% pay cut for each child, while men receive a 6% pay increase. Mothers face discrimination in terms of promotions, hiring, and bonuses. They must put up with lower job site evaluations that indicate they are less credible or involved in their work than non-mothers.

Even in today’s world, where equality appears to have been achieved, mothers continue to be underpaid due to their traditional responsibilities to children. According to studies, the impact of parental and marital status on men’s and women’s earnings can explain 40% to 50% of the gender gap.

Another concept opposed to this is the ‘Fatherhood Premium,’ which provides fathers with an increase in income when they have a child. The worst part is that the motherhood penalty, also known as the child wage penalty, is more prevalent in blue-collar or low-wage jobs, where women are least able to afford it.

This type of penalty is prevalent in India. Still, it can also be found in many other countries worldwide, including developed nations such as the United States, Japan, South Korea, the United Kingdom, Poland, and Australia. Critics argue that mothers must take more maternity leave or work fewer hours than non-mothers to justify their lower pay.

Women even take time away from work to care for their children, only to look for a new job again, which reduces their salary even further. However, this only accounts for about one-third of the child wage penalty.

According to research conducted in the United States, changes in work behavior and absenteeism can explain a portion of the child wage penalty. Further, only a small portion of the father’s wage premium is due to a greater workload when compared to men without children.

This suggests that cultural factors (negative perceptions of women’s responsibilities) are at work, as are positive views of fathers in the workplace, which are likely associated with the traditionally male breadwinner role.

Therefore, we require some solutions to help us correct the situation. Promoting EQUAL PARENTING is one of the steps that can be taken. If both the mother and father share equal responsibility for their child, the mother will feel less pressure and will be able to focus on her work.

Childcare facilities in offices can also be of great assistance in creating a sense of balance. Lactating mothers will also benefit from this. Further, part-time and flexible job opportunities are required to ensure that women remain in the labor force.

To summarise, given parental support and a reduction in workplace discrimination, the child wage penalty can be significantly reduced, allowing mothers to avoid paying the penalty for a miraculous gift from nature.

Article Summary: This article discusses one of our payment system’s major concerns, the “child wage penalty” (one of the major issues of gender inequality), and how working mothers are perceived as less credible. It also emphasizes the income disparities between males and females as parents and how working women with children face workplace bias during promotions, hiring, and bonuses. The solution to this significant issue has also been briefly touched upon.

(Wajeeha Ashfaq Hamdani is a B.A.(Hons.) Economics student at Jamia Millia Islamia, Delhi, and a part GAEE JMI, an autonomous branch of Global Association of Economics Education in India. The views expressed are personal and they do not purport to reflect the opinions or views of GAEE or its members.)

Follow Us & Stay Tuned: https://linktr.ee/gaee.jmi

Recent Comments